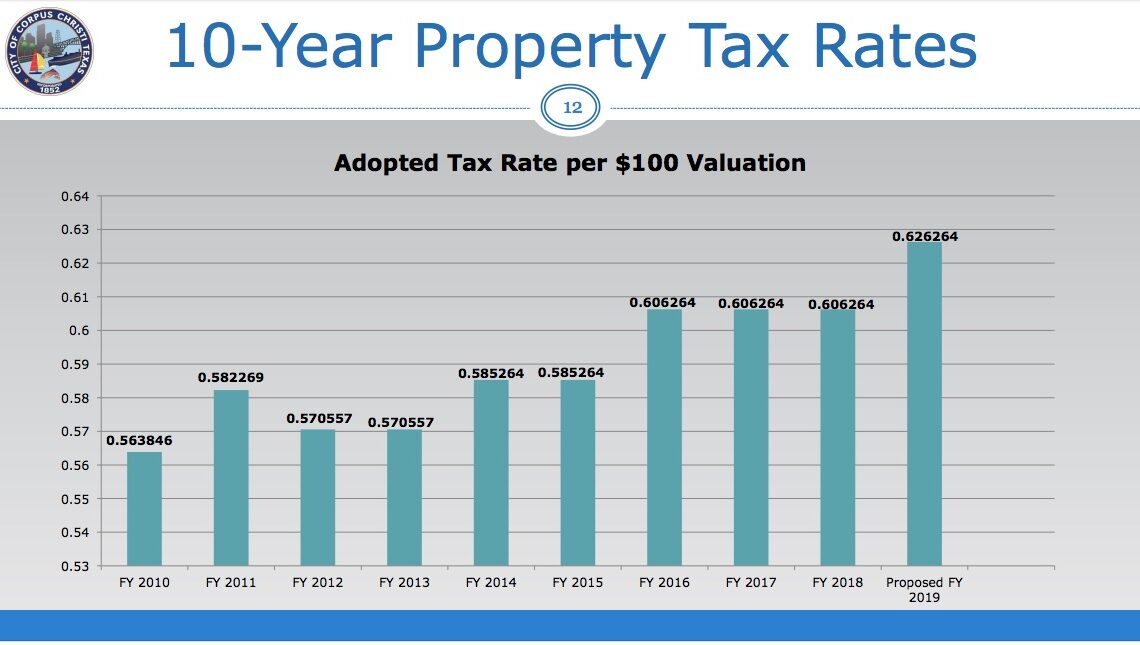

A city chart showing the increase in tax rates in Corpus Christi over a 10-year period. The rate dropped once in 2012 but made a steep increase in 2016. That rate held for three years straight before increasing by 2 cents this year. Courtesy illustration

Property taxes are going up for many Corpus Christi and Nueces County residents along with a nearly 4 percent increase in property valuations in most of the county. Four entities — the city of Corpus Christi, Nueces County, Del Mar College, and the Corpus Christi Independent School District — have recently approved property tax rate hikes. The city of Port Aransas and the Port Aransas Independent School District also raised taxes, but, with property valuations dropping, many homeowners will not see an increase in out-of-pocket payments.

Valuations and tax rates are mostly set in the early weeks of September. On Sept. 18, Corpus Christi City Council approved an increase of 2 cents per $100 valuation to pay for a 2016 voter-approved bond. The money will be used for street repairs.

Nueces County commissioners gave final approval Sept. 12 to a rate hike of 1.3 cents per $100 valuation after going over the budget line by line for four hours. Originally, commissioners were looking at a 1.5-cent increase. A 3-2 vote to pass the 2018-19 budget shaved 0.2 cents off the hike. Commissioners Joe A. “Jag” Gonzalez and Carolyn Vaughn voted “no” because, they each stated, they did not want any increase.

“Our people are being taxed to death,” Vaughn said at the meeting. “That’s not counting the utilities that are going to go up.”

Del Mar College raised its tax rate to $0.281885 per $100 valuation, a 12.94 percent increase. The money will be used for employee pay increases, including raises for full-time faculty. The next biggest expense in the new budget is to establish a campus police department, which is expected to cost $233,000. A portion of the proceeds will be for operations and maintenance.

The Corpus Christi Independent School District’s two-part rate hike will be used to pay for repairs after Hurricane Harvey damaged campuses last August. One part will also fund bond issues and pay for day-to-day operations.

The maintenance and operations tax rate was raised by 4.5 cents after 10 years at the same rate. The increase is a one-time adjustment and will return to $1.06005 for the next budget cycle. No voter approval is needed for the atypical hike because the money is being used to rebuild after a natural disaster.

The I&S tax rate — or interest and sinking — pays for bond issues and construction projects. That rate was increased by 2.27 cents. CCISD is building two new schools. A groundbreaking ceremony for the new Windsor Park Elementary School was held Aug. 1. The district is also building a new Carroll High School.

Property valuations set by the Nueces County Central Appraisal District are up about 4 percent, appraiser Ronnie Canales said. The numbers are on the downside compared to about four years ago when property valuation increases were in the double-digits.

“The economy has slowed down,” Canales said.

Nueces County, with the exception of Port Aransas and Mustang Island, increased just over 4 percent.

Also increasing about 4 percent were valuations for property in the Del Mar College district, the city of Corpus Christi, and CCISD. For Del Mar, that means an additional $375 million in property value to tax. Property valuations are up by $300 million in the city of Corpus Christi.

Property valuations in Port Aransas tell a different story. Hardest hit by Hurricane Harvey, the area “probably lost close to $375 million from year to the next,” Canales said.

“The effects of Hurricane Harvey were drastic in the Mustang Island/Port Aransas area,” he said. “The county (finances) took a hit, too, because of Port Aransas.”

The area is making a comeback, however, he continued.

“They have done a commendable job recovering,” Canales said.