More frequent, stronger hurricanes and tropical storms have made landfall along the Texas Gulf Coast in the past few years, intensifying a battle between the Texas Windstorm Insurance Association and residential and commercial property owners, who must buy policies from TWIA as the insurer of last resort in the area. Courtesy image

No windstorm insurance rate hike for 2021, voted the Texas Windstorm Insurance Association board of directors during a meeting Aug. 4. The board is required to file a rate request with the Texas Department of Insurance no later than Aug. 15 each year for the previous year. Any hike request must be approved by the insurance commissioner before it can take effect on Jan. 1 of the next year.

In the case of the 2021 insurance rates, the rate request was a 0 percent hike. That recommendation came despite a 2020 rate analysis indicating residential rates are 44 percent inadequate and commercial rates are 49 percent inadequate.

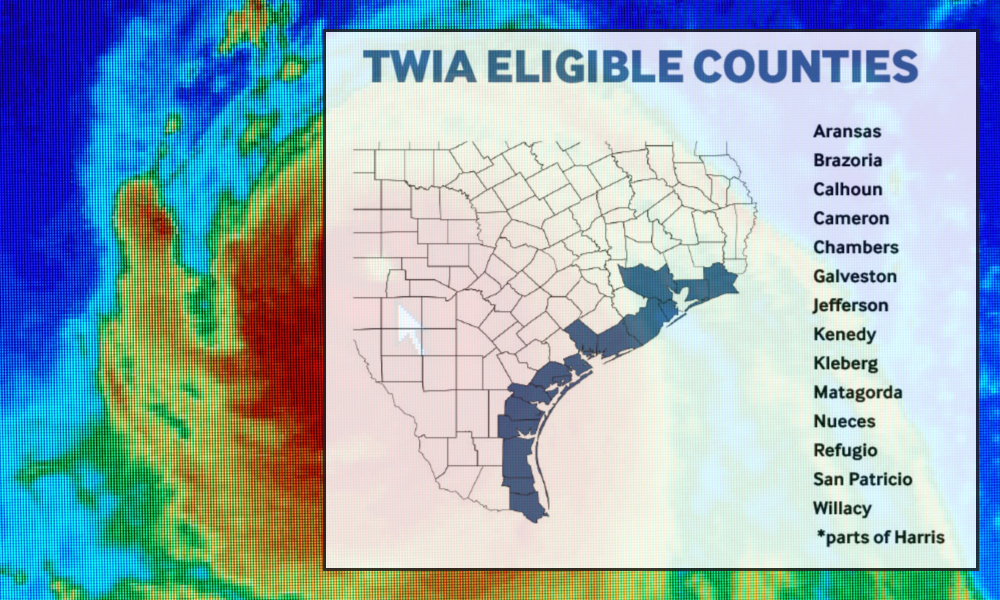

“Current TWIA rates are uniform throughout the 14 first tier coastal counties,” reads an explanation of rate adequacy on the TWIA website. “Because rates do not vary based on any geographical factors, such as distance from the coast, rates may be actuarially adequate in some areas.”

The board voted to revisit the issue at an interim meeting before its next quarterly meeting in December. It directed the Actuarial & Underwriting Committee to make another recommendation based on competition of an independent rate adequacy study currently underway. The study is being done by a newly hired firm, Willis Towers Watson, which promised new numbers by the end of August.

TWIA can make a rate filing at any time but is required to do so by the Aug. 15 deadline each year. Rates increased by 5 percent each year from 2011 to 2016 and again in 2018. A proposed 10 percent rate increase set to go into effect in 2019 was temporarily suspended by Gov. Greg Abbott in October 2018 to give the Texas Legislature time to consider new legislation dealing with catastrophic insurance.

As the 2019 legislative session drew to a close, TWIA withdrew its request for the 10 percent increase. Since then, a series of actuarial committee and board meetings have had discussions of a rate increase on the agenda.

State Rep. Todd Hunter (R-Corpus Christi), an active opponent of any windstorm insurance increase, brought together Gulf Coast organizations and residents to send a clear message of “No Rate Hike” as part of public comment each and every meeting. He and the local delegation have all been vocal in their opposition.

“It appears that they listened to the coastal legislators and the coastal communities,” Hunter said. "We will continue to fight no rate hikes. The issue is not over, but we are gaining strength for no rate increase. It was a victory for the Coastal Bend.”