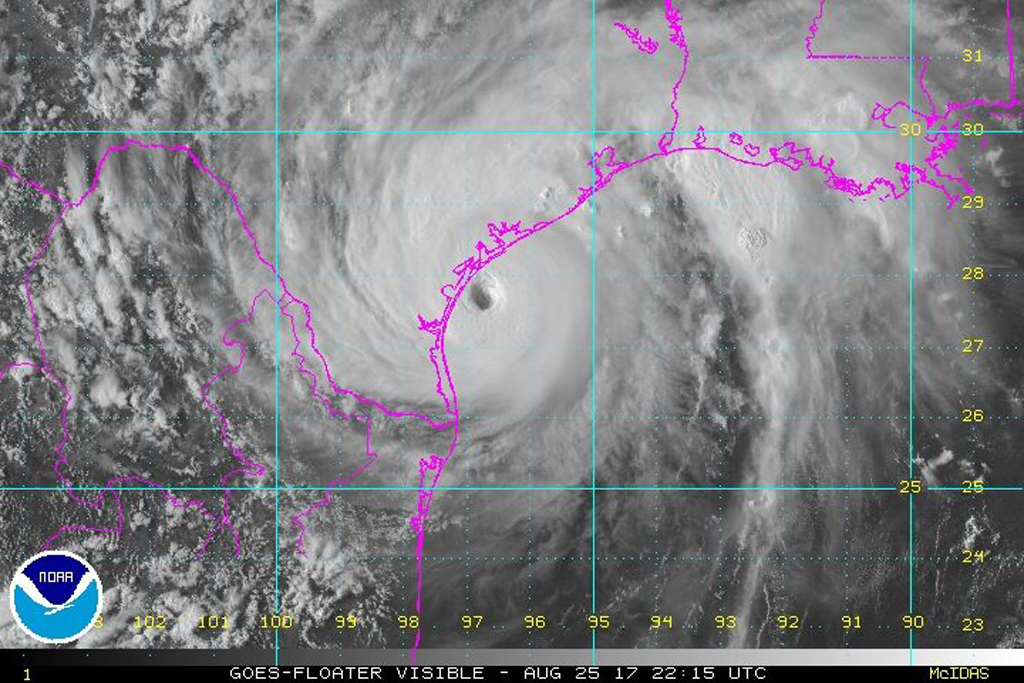

Hurricane Harvey, a Category 4 storm that hit the Coastal Bend in August 2017, causing extensive storm damage. Harvey was just one of several major wind storms that have hit the area in recent years. . Courtesy map

Another recommendation to raise windstorm insurance rates by 5 percent is on the Texas Windstorm Insurance Association agenda for its annual meeting Aug. 3. The recommendation comes from TWIA’s Actuarial and Underwriting Committee, which met via Zoom on Wednesday, July 21. The 5 percent increase would be for residential and commercial policies.

At the committee meeting, a Rate Adequacy Analysis was presented indicating TWIA rates are inadequate by 39 percent for residential coverage and 46 percent for commercial coverage. A 2019 study showed residential rates were 41 percent inadequate and commercial rates were 50.1 percent inadequate.

An attempt to raise the rates by 5 percent based on those numbers was thwarted by the state insurance commissioner in January due to a lack of transparency. The meeting agenda did not clearly indicate a rate vote was imminent, the commissioner said.

The TWIA board will consider the recent recommendation at its quarterly meeting in August. The board is required to file a rate, even if it is zero percent, with the Texas Department of Insurance no later than Aug. 15 each year. The annual rate filing is subject in certain circumstances to review and approval by the insurance commissioner.

The Actuarial and Underwriting Committee also addressed proposed policy form updates and an update to the association’s rate manual at the July 21 meeting.

TWIA staff were asked to provide a timeline for completing requested research to the board at the Aug. 3 meeting regarding the following topics:

- a review of the amount of current building code credits offered by TWIA;

- additional research on retrofit building credits;

- identifying existing insured property that might be eligible for credits that are not being provided;

- and identifying and comparing discounts in other states, including that of the Florida Citizens Property Insurance Corp., and the private market to TWIA policies.

The Aug. 3 meeting will be held via teleconference. An agenda, meeting materials, and the broadcast link will be posted prior to the meeting.